Tax Refund at Kansai International Airport (KIX)

OsakaAirport.com » KIX » Shops and Services » Tax RefundConsumption tax in Japan, may known as Sales Tax, VAT or GST in other countries, is a flat 10 percent for all items except foods, beverages and newspaper subscriptions for which it is 8 percent (not including alcoholic drinks and dining out). Shops are required to show price tags that include the tax; however, pre-tax prices may also be listed alongside the total amounts, resulting in some price tags that list two prices.

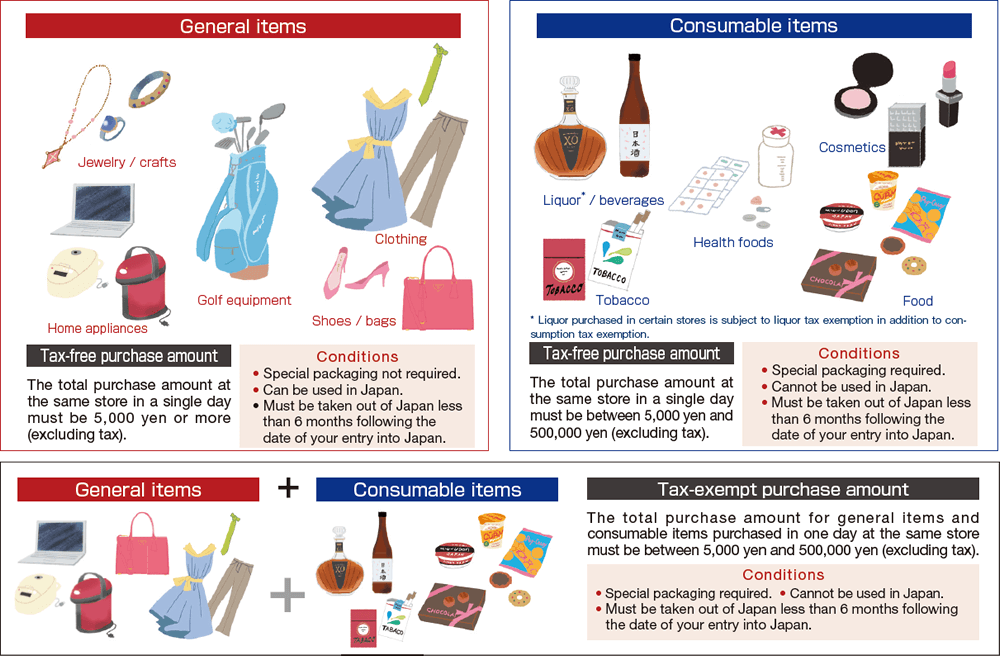

Tax free shopping is applicable to foreign visitors staying in Japan for less

than six months only and only available at licensed stores

when consumed at least 5000 yen or more at a given store or mall on same day. Note that at most of shops and

malls, it is necessary to first pay the full price (including the consumption

tax) at the cashier and then claim a refund from a customer service desk. A passport is required when you want to claim a refund.

Payments for items that are clearly for consumption within the country such as meals at restaurants are not eligible for tax exemption.

Purchases made for business or sales purposes are also not eligible for tax exemption.

Liquor purchased from direct sales stores at approved factories producing liquor such as sake, shochu, wine, and whiskey in Japan will be exempt from liquor tax as well as consumption tax.

folder_open...Shops and Services